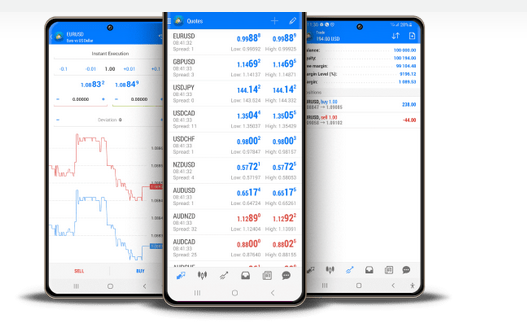

Metatrader 4 is a free investing software program that is utilized by millions of forex forex traders around the world. It is actually a potent tool that comes full of numerous features, such as customizable graphs, an extensive analysis toolkit, and the cabability to blend other investing equipment. Even so, learning Metatrader 4 can be quite a difficult project, particularly if certainly are a rookie. In this thorough guideline, we are going to check out the different factors of Metatrader 4 and provide you with the knowledge to become a successful forex trader.

1. Comprehending the User interface:

Step one towards understanding Metatrader 4 is understanding its graphical user interface. Metatrader 4 comes with an easy-to-use program that may be split into 4 principal elements, specifically the marketplace see windows, the navigator home window, the graph or chart windowpane, and also the terminal windowpane. The marketplace observe windows screens the different foreign currency sets and devices you could buy and sell. The navigator window screens the different indicators, specialist experts, and scripts that can be used to help you business. The graph or chart windows exhibits the actual-time value charts of the a variety of currency exchange pairs and instruments. The terminal windowpane exhibits your money information, your investing historical past, as well as lively deals.

2. Modifying Graphs:

The Metatrader 4 platform comes with a array of customizable maps. Customizing your maps will help you envision selling price actions and examine tendencies efficiently, hence helping you to make informed investing selections. It is possible to customize your charts by altering the graph type, modifying enough time frame, transforming the colour techniques, including different specialized signs, and more.

3. Beneficial Characteristics:

Metatrader 4 is available packed with numerous features which can help you optimize your buying and selling expertise. Many of the most useful capabilities consist of one-click on trading, automated buying and selling, a variety of purchase varieties for example stop-loss and limit orders placed, and the cabability to backup deals off their dealers utilizing the indicators services.

4. Forex trading with Professional Analysts:

A specialist advisor (EA) is a important instrument that allows you to speed up your trading techniques. EAs can evaluate the stock markets to make forex trading decisions based on particular variables. To utilize an EA, you need to transfer it into the Metatrader 4 foundation and attach it to a specific chart. Then you can change the variables in the EA to fit your forex trading technique.

5. Chance Management:

Successful danger administration is an essential aspect of currency trading. Metatrader 4 provides several threat administration tools that will help you maximize your buying and selling plan. Probably the most beneficial equipment consist of cease-loss orders and get-revenue orders, that can help restriction your loss and lock in profits respectively. You may also utilize the margin call feature to stop your account from getting depleted should your investments go against you.

Verdict:

In conclusion, understanding Metatrader 4 is an important key to becoming a effective fx trader. In this extensive manual, we now have considered the many aspects of Metatrader 4, which includes learning the interface, personalizing charts, making use of useful characteristics, buying and selling with professional experts, and risk control. By using the information provided in this particular guideline, it is possible to improve your investing practical experience and achieve your buying and selling targets. If you are a newbie or perhaps seasoned investor, Metatrader 4 is a powerful tool which will help you be successful in the foreign exchange market.