Welcome to our blog post on harnessing volatility for successful Cfd trading! Volatility in the financial markets can be both a blessing and a curse for traders. While it can lead to increased profits, it also comes with higher risks. In this post, we will explore some strategies that can help you navigate volatile markets and make the most out of your Cfd trading experience.

The first strategy for successful Cfd trading in volatile markets is to have a solid risk management plan in place. Volatility can lead to rapid price movements that can result in significant losses if not managed properly. By setting stop-loss orders and limiting the size of your positions, you can protect yourself from large drawdowns and preserve your capital. It’s also important to diversify your portfolio and not put all your eggs in one basket. This way, if one trade goes south, you won’t lose everything.

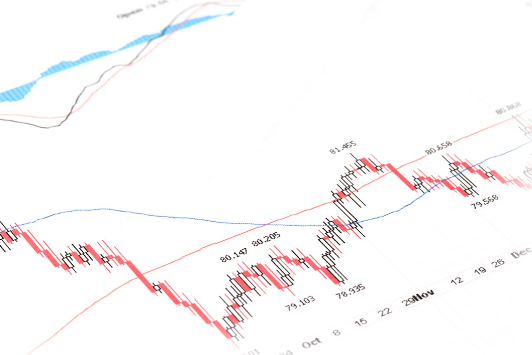

Another key strategy for successful cfd trading in volatile markets is to stay informed about market news and events that could impact asset prices. Volatility often stems from unexpected developments such as economic data releases, geopolitical tensions, or corporate earnings reports. By staying up-to-date with the latest news and trends, you can anticipate potential market movements and adjust your trading strategy accordingly. This includes using technical analysis tools to identify support and resistance levels, trend lines, and other patterns that can help you make informed decisions.

In addition to risk management and staying informed, it’s also important to have a well-defined trading plan when navigating volatile markets. This plan should outline your entry and exit points, as well as your profit targets and stop-loss levels. Having a clear plan in place will help you stay disciplined and avoid making impulsive decisions based on emotions or market noise. It’s also essential to stick to your plan even when things get chaotic, as deviating from it could lead to costly mistakes.

Furthermore, consider using leverage wisely when trading CFDs in volatile markets. While leverage can amplify your profits, it can also magnify your losses if not used prudently. Make sure to only use leverage that you are comfortable with and never risk more than you can afford to lose. Additionally, consider using risk-management tools offered by your broker such as guaranteed stop-loss orders or trailing stops that can help mitigate risks associated with high volatility.

In short: In In short, successfully navigating volatile markets requires a combination of risk management, staying informed about market developments, having a well-defined trading plan, and using leverage wisely. By implementing these strategies into your Cfd trading routine, you can harness volatility to your advantage and increase your chances of success in the financial markets. Remember that volatility is a double-edged sword – while it presents opportunities for profits, it also comes with increased risks that must be managed effectively. Happy trading!

Harnessing Volatility: Strategies for Successful Cfd trading

Categories: